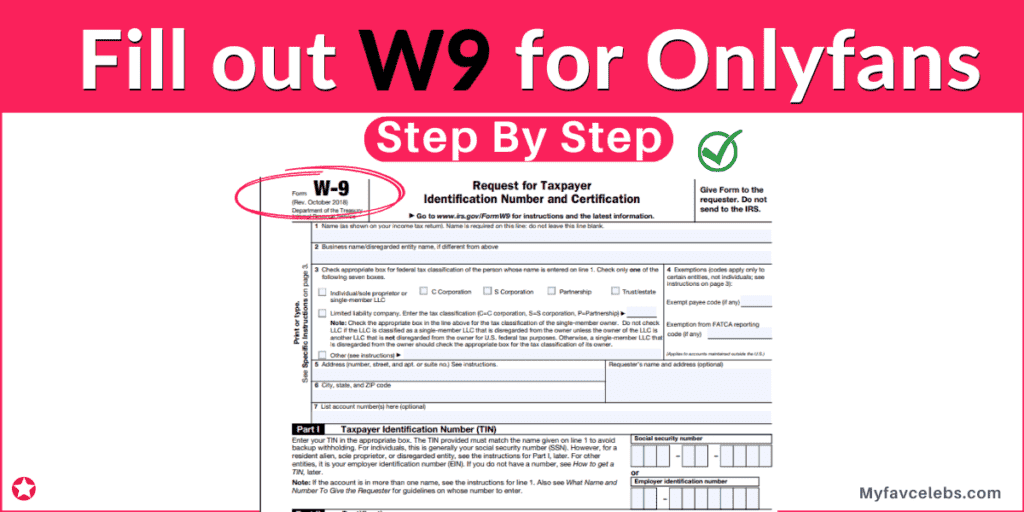

Being an onlyfans creator, you must fill out a W9 form for onlyfans to receive payments. It’s an effortless task, but some creators got stuck between lots of blocks, check marks, and technical terms, which is a little scary for them. But if you have just started onlyfans and have no idea How to fill out W9 for Onlyfans as a creator, this guide is for you. We are here to help and guide you step by step so you can fill out the W-9 form error-free.

If you live in the U.S., filling out the IRS form is required for most online subscription-based social media like onlyfans. The aim of a form W-9 is for a business (here onlyfans) to collect essential info (e.g., name and tax number) from an independent creator before they pay them.

In this article, we’ll explain what this form is for creators and how to successfully fill out the w9 form without mistakes so that you can receive earnings in your account.

Before we move further, let’s see what is this form and how it helps in a tax return.

Note: Here, we are talking about form in the context of Onlyfans creators only.

This guide is also helpful for Patreon creators, freelancers, fansly, and other subscription-based social media services.

Calculate your Onlyfans earnings using Onlyfans Income Calculator.

What is form W-9 form for onlyfans creators?

If you start a new account as a creator, then this subscrition based social media will ask you to complete this form. At the end of the year, you’ll get a 1099 Form (onlyfans 1099).

Now the question is, what is the use of the form for online creators, and why do you have to pay taxes?

So, The subscrition based social media will collect essential info (e.g., name and tax number, social security number) through a form from an independent creator.

IRS Form, also known as a W9, is one of the many tax documents required by the Internal Revenue Service (IRS ) to help accurately count the taxes owed by creators in a given tax year.

This form requires the independent creators to state (under penalty of perjury) that they are a U.S. person (a U.S. corporation, a U.S. citizen, or a legal resident alien).

How to fill out W9 for Onlyfans? – Step By Step

Whether you are a creator, self-employed freelancer, sole proprietor, or any other online worker, here is the complete guide to filling out the W-9 form. It is very easy, but all you need to do is read the complete article carefully. We have divided this form as per your convenience with CASE A, B, C, D. Choose as per your suitability.

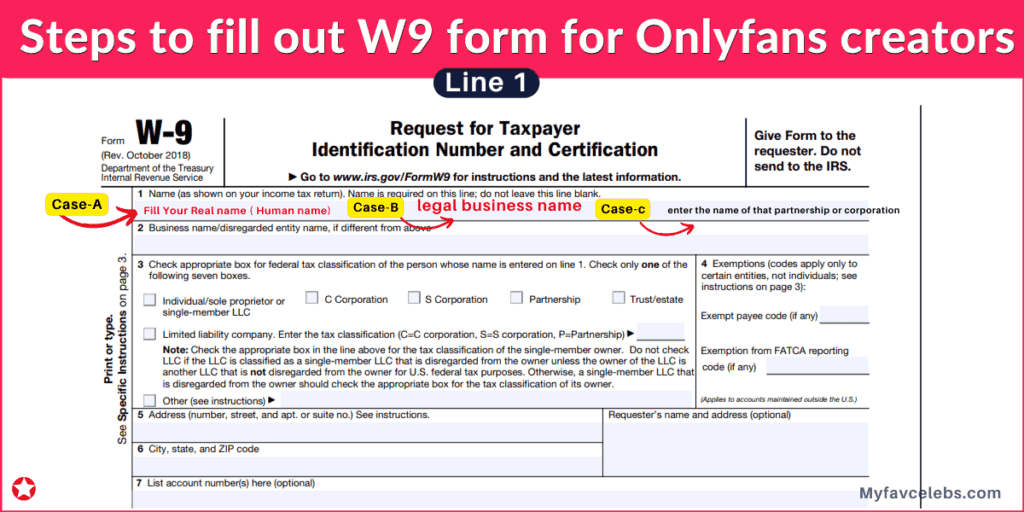

Line 1

Case-A

If you are a creator or do freelancing work without a business entity or through a single-member LLC owned by you, then enter your real name on line 1.

Case-B

If you work via a partnership (including an LLC with at least two creators), an S corporation, or a C corporation, enter the legal business name on line 1. Here you should note that only the company’s official name should be entered, which is indicated in the company’s formation papers.

Case-C

If you work through a single-creator or member LLC wholly possessed by a partnership, S corporation, or C corporation, then you have to enter the name of that partnership or corporation on line 1. Hope you are enjoying our article on how to fill out a W Nine. Read below for further instructions.

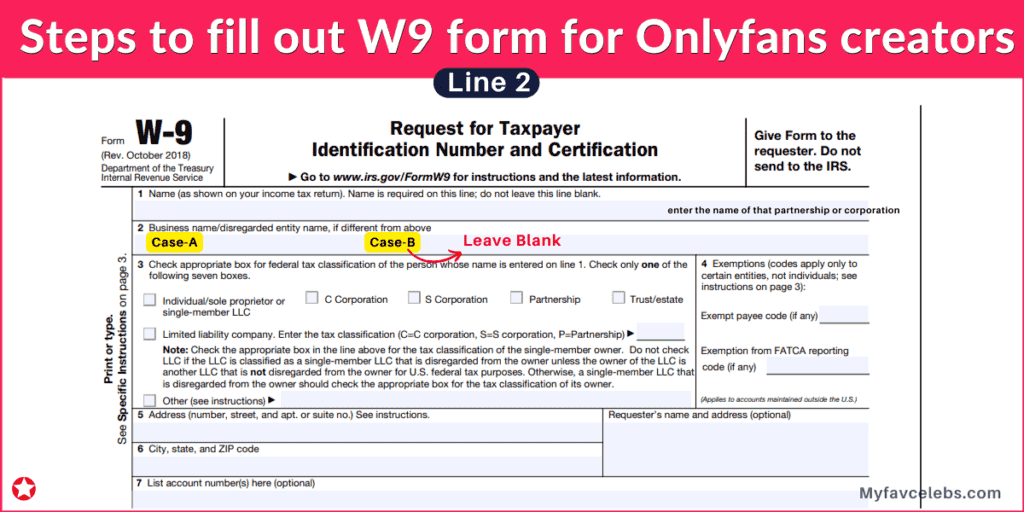

Line 2

Case A

If you have a disregarded entity name or DBA (‘doing business as‘) name distinct from the name you entered on line 1, then enter it on line no 2.

For example, if Ashley is onlyfans creator through a single-member LLC that she owns named “Creator Ashley LLC,” then she would enter “Ashley” on line 1 and “Creator Ashley LLC” on line 2.

Case B

And If you do not have a disregarded entity name or “Doing business as” name separate from what you entered on line 1, leave line 2 empty.

Line 3 on the w-9 form

Case A ( For most of the creators)

If you are an individual creator and the name you entered on line 1 is your real name (human), check the box labeled “individual/sole proprietor or single-member LLC.” Most of the creators of this subscription-based social media select this option.

Now, check the box for C corporation if you have entered the name on line 1 as a corporation taxed as a C corporation.

If you have entered the name on line 1 as an LLC taxed as a C corporation, you have to select the box for LLC and enter the letter “C” in the space next to it.

If you have entered the name on line 1 as a corporation taxed as an S corporation, check the box for S corporation.

As a creator, If the name you entered on line 1 is an LLC taxed as an S corporation, check the box for LLC and enter the letter “S” in the space next to it.

Lastly, If the name you entered on line 1 is an LLC taxed as a partnership, check the box for LLC and enter the letter “P” in the space next to it.

Note: Check just ONE box in section 3 (not two and not zero).

Line 4

Generally, as an individual creator, you’ll leave this section blank. Now we will move further to fill this form for this site users.

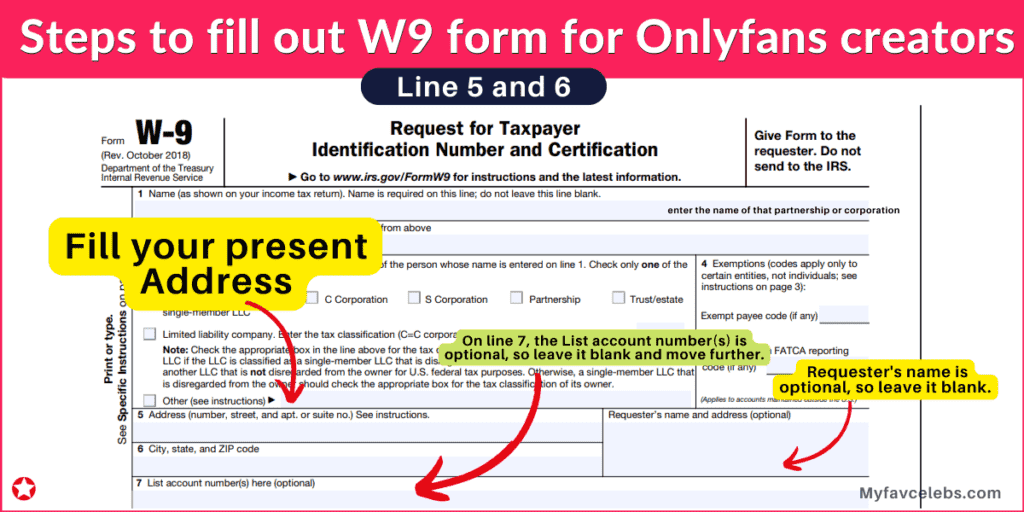

Lines 5 & 6

In lines 5 and 6, you must fill out your mailing address to receive any important documents in the future.

Here Requester’s name is optional, so leave it blank. However, Onlyfans.com is your Requester in this form, so leave it blank, and they will take care of it.

On line 7, the List account number(s) is optional, so leave it blank and move further.

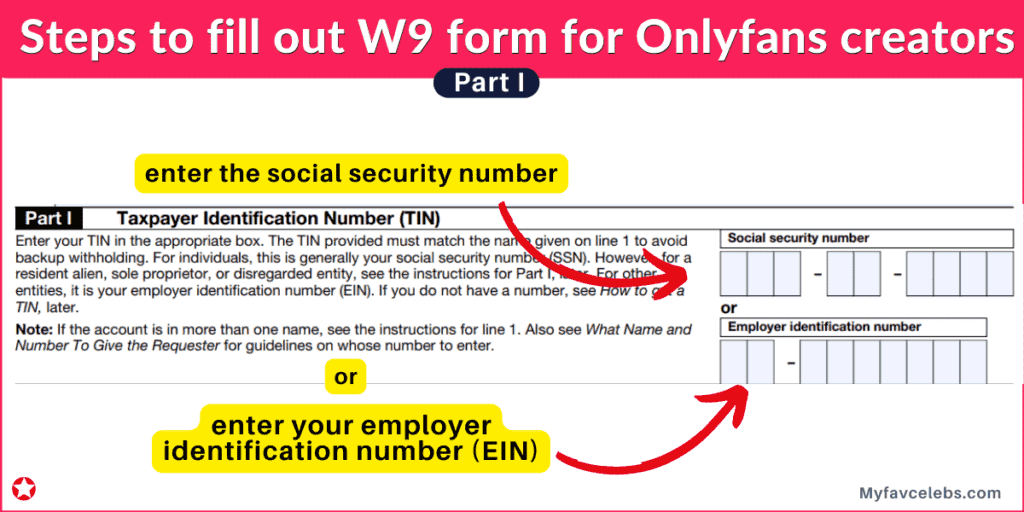

Part I

Now it’s time to fill in part-I. As an online creator, If you have mentioned your real name on line 1 and have a social security number (SSN), then enter the social security number.

However, if you do not have a Social Security number, you can also enter your employer identification number (EIN).

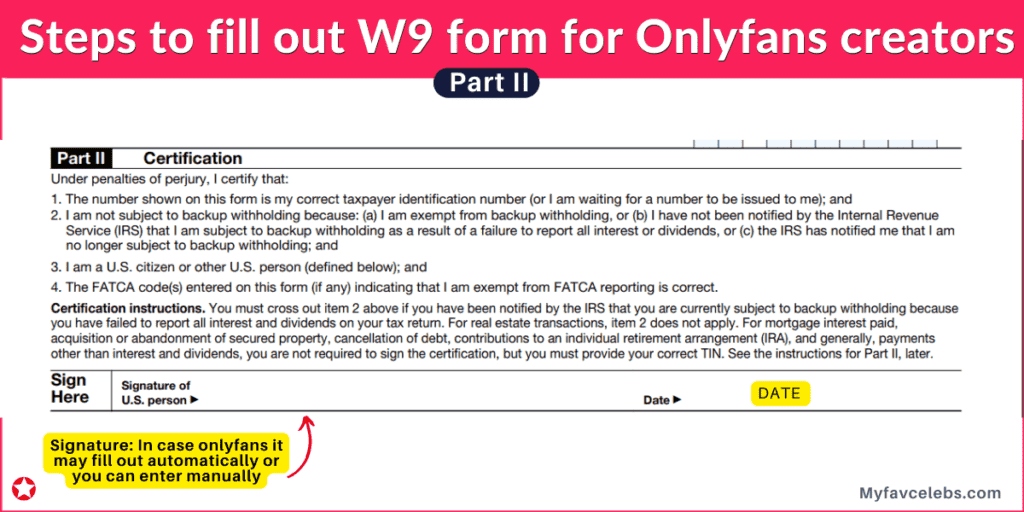

Part II

Part II is all about certifications; just read the three lines. They just ask you to certify that you have correctly given all the above details. You also have to ensure that The number shown on this form is your valid taxpayer identification, along with whether you are a U.S. citizen or another U.S. person.

Now you will see the signature of the U.S. person and date section. If you are filling it in only fans, then they will fill this section automatically. However, if you do not see anything, you must enter your name and date.

We recommend you carefully read all the instructions and terms and scroll down to hit the send button.

Note: DO NOT SIGN or use this form if you are not a U.S. person or business. Ask a tax professional if you are unsure whether you are a U.S. person or a business.

What do you do with form W-9 after filling it out?

You do not have to submit the form to the IRS. As subscription-based social media asked you to fill out this form then fill out form and click the send button.

Only fans will do the rest on their end.

Feel free to share it with your friends. This guide is for learning purposes if you have any confusion then consult with your tax consultant. You can read all the terms and conditions of the form here.

Conclusion on W9 form for Onlyfans

Hope you liked this ultimate guide on How to fill out W9 for Only fans as a creator. We have given all the required steps and shared with screenshot. Now you will able to fill your form successfully without mistakes.

If you liked this article feel free to share it with your friends.

Now we will move to the FAQs section to clear your reaming doubts.

FAQs

what is the w9 form for onlyfans creators?

U.S onlyfans creators have to fill out the IRS form W-9 is required for most online subscription-based social media. The aim of a form W-9 is for a business to collect essential info (e.g., name and tax number) from an independent creator before they pay them.

Do you have to fill out a w9 for onlyfans?

Yes, you have to fill out this form as a creator.

what do I put on my w9 for onlyfans?

You have to fill social security number, real name or business name, mailing address, date, and type of business. However, you can read our complete guide.

What is the W9 tax form onlyfans?

It is a form that onlyfans ask creators to fill out so they can show it to IRS.

You May Also Like:

Onlyfans Menu templates, ideas

Weird Ways to make money on OnlyFans

How to be successful on onlyfans?- 12 Steps to Succeed

Hello! My Self Olivia Johnson.

I am a passionate writer and love writing blogs. I am also very much interested in the professional world of writing. As of now, I am working for Myfavcelebs.com as a full-time content writer. I have completed my graduation in English Subject and love to read books.

Feel free to comment with your suggestions.

Best Regards

Olivia Johnson ( Author at Myfavcelebs.com)